Since Brexit has taken place, it has meant that there are now new rules to duty-free allowances! But you don't need to worry too much, you can still bring a fair amount of goods and services into the UK without being charged extra tax. We will go over the new rules and try to make it as simple as we can for you!

When you are bringing the goods to the UK, you have to be bringing the goods in yourself. They can be for your personal use or you could give them away as a gift. But remember, you must not go over your allowance and if you do, you have to declare it before arriving in the UK to whichever category they fit. We will talk about the different categories and the allowances for different categories below.

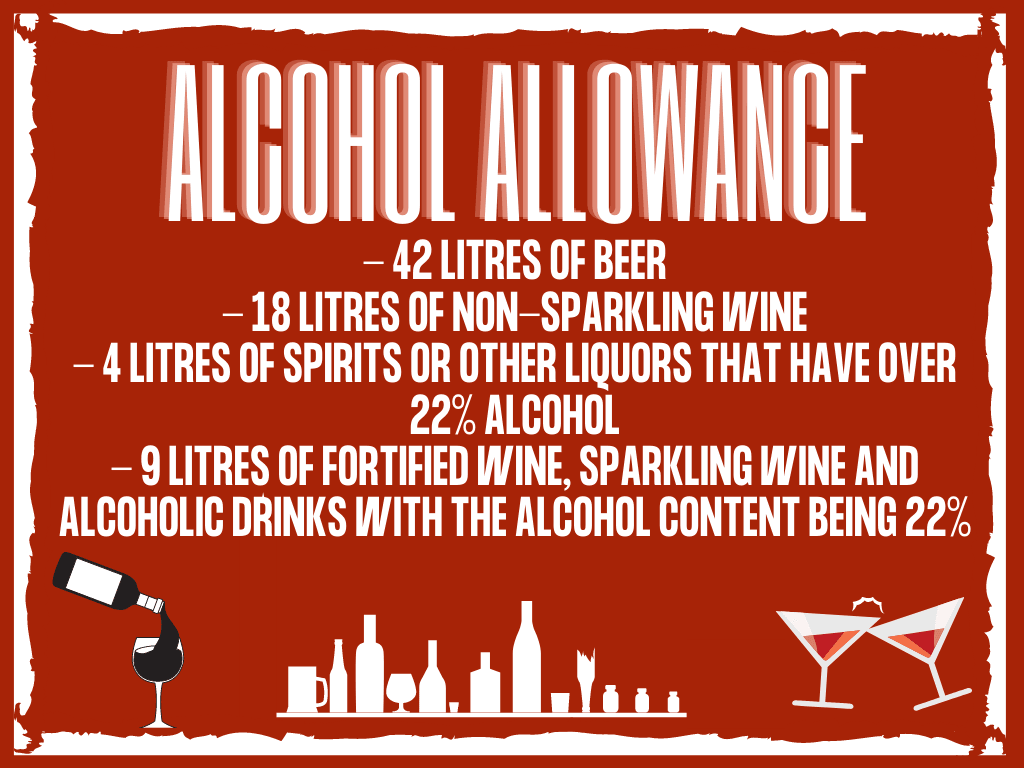

You are allowed to bring a generous amount of alcohol! You may bring in:

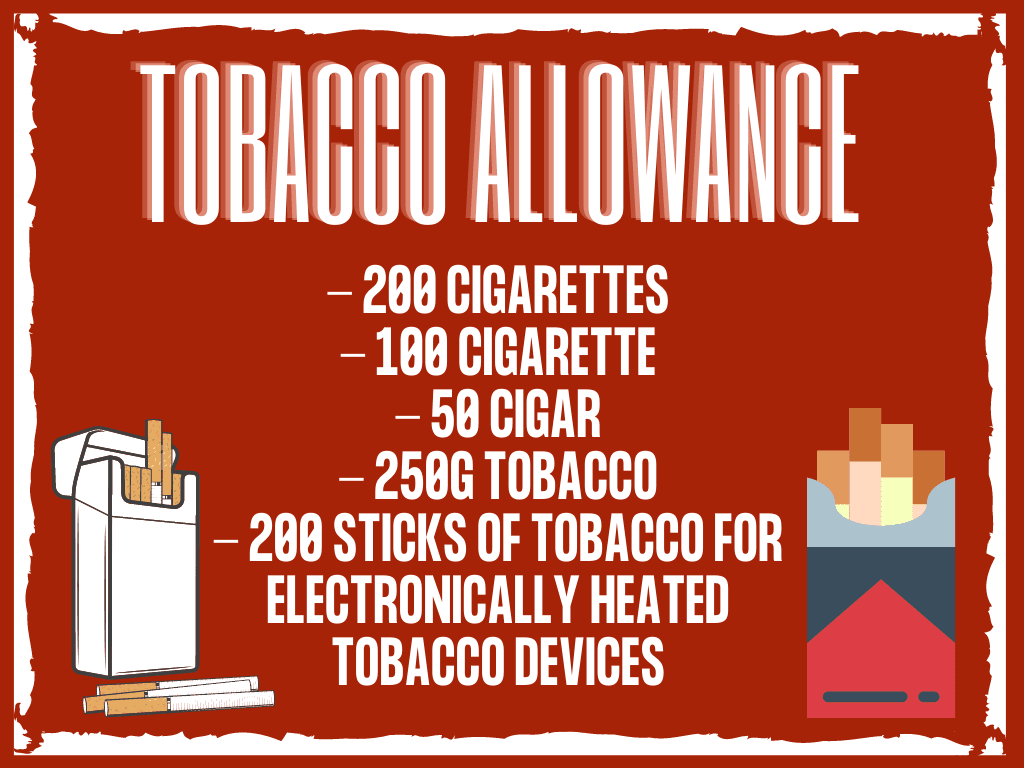

For tobacco allowance, there is a generous amount available too! You may bring in:

If you're under the age of 17, then, unfortunately, you are not allowed any personal allowance. However, if you still wish to bring it, you will have to pay tax and dut on them before your arrival in the UK.

If you want to bring other goods, you can bring up to £390. If you want to bring more, you will have to pay duty and tax on the total sum not just the sum that's gone above the allowance. Make sure that you don't go over because you may have to pay import VAT too as well as duty and tax. We're sure you don't want to do that so ensure your total sum doesn't go over the limit!